Agricultures, Foods, News & Event

“Great leap forward” in fruit and vegetable export

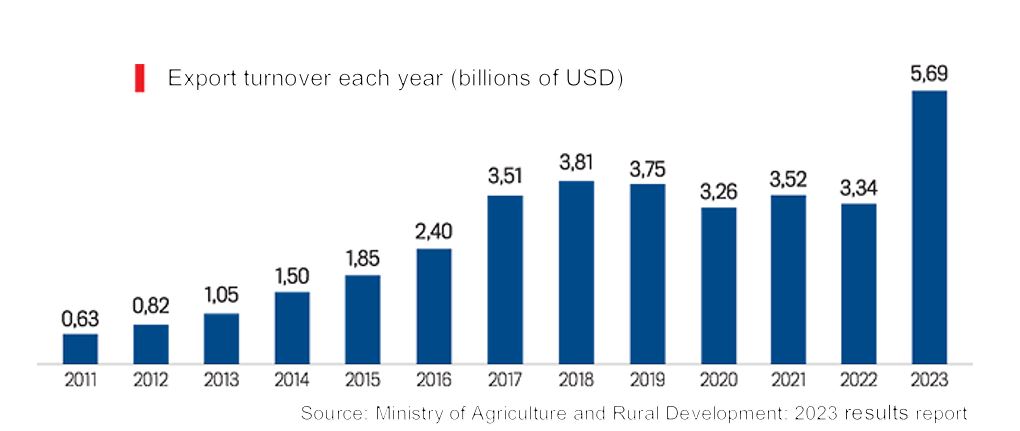

In 2023, vegetables and fruits will be the export commodity group with the most impressive growth rate, with a record turnover of 5.69 billion USD, an increase of 69.2% compared to 2022. This is also the first industry to open up. 5 billion USD “club” to “welcome” other agricultural products in the coming years…

Regarding the types of vegetables and fruits exported in 2023, compared to the same period in 2022, the fruit group (fresh and frozen) reached 4.2 billion USD, an increase of 112%; Next is the processed fruit and vegetable group with nearly 1.2 billion USD, an increase of 18%; Vegetable group reached 279 million USD, an increase of 4.9%. Regarding the market in 2023, China continues to hold the No. 1 position with a turnover of more than 3.7 billion USD, an increase of 149% (equivalent to an increase of more than 2 billion USD) compared to 2022 and accounting for about 65.4%. total fruit and vegetable export turnover of countries.

14 ITEMS WITH “VISA” TO CHINA

As for durian products, in just 10 months of 2023, exports have officially surpassed the 2 billion USD mark when reaching 2.07 billion USD, an increase of 606.3% over the same period in 2022. For the whole year 2023, exports Durian exports brought in 2.24 billion USD. Thus, durian is the number 1 export product of the fruit and vegetable industry.

The reason durian has achieved such a “great leap forward” is thanks to the Durian Export Protocol between Vietnam and China signed in July 2022, from now on, Vietnamese durian is allowed to export officially. into the Chinese market. If in 2022, durian exports only reach 420 million USD, then in 2023 it will reach 2.24 billion USD, an increase of 5 times compared to 2022 and an increase of 10 times compared to 2021.

According to forecasts, by 2025, China’s durian market could reach 20 billion USD and the world’s 28.6 billion USD. The demand for durian consumption in a market of 1.4 billion people like China is very large, combined with all durian exporting countries in Southeast Asia, it is still not enough to meet this market demand. Meanwhile, compared to other countries in the region, Vietnamese durian exported to China has many competitive advantages in logistics and quality.

Up to this point, Vietnam has had 14 agricultural products with “visas” for official export to the Chinese market, including: bird’s nests and products from bird’s nests, sweet potatoes, dragon fruit, longan, and rambutan. , mango, jackfruit, watermelon, banana, mangosteen, black jelly, lychee, passion fruit and durian.

To continue to open the door to other agricultural products, Mr. Huynh Tan Dat, Director of the Plant Protection Department, Ministry of Agriculture and Rural Development, said that the Department is coordinating with the General Administration of Customs of China (GACC). ) urgently complete market opening documents for 5 products including: citrus fruits (grapefruit, oranges, tangerines…), coconut, frozen durian, chili, and medicinal herbs. If the Protocol with these products continues to be signed, Vietnamese fruit, vegetable and agricultural product exports to the Chinese market will have many big surprises, helping many fruits join the billion-dollar “club” in the coming years. next time.

Mr. Tran Van Duc, Chairman of the Board of Directors of Ben Tre Coconut Investment Joint Stock Company, shared: although the company’s processed coconut products have conquered high-end markets such as Europe, America, and the Middle East. but still cannot enter the Chinese market because the two countries do not have a Protocol. Ben Tre alone last year coconut exports reached 420 million USD, of which more than 85% were processed products. If this product can be opened to the Chinese market, earning billions of dollars from coconut exports is completely within reach.

NOT “NARROW” IN ONE MARKET

Although Vietnam’s fruit and vegetable exports are making a “great leap” into the Chinese market, the market share of Vietnamese vegetables and fruits in the European Union (EU) market is very modest. The EU is the world’s largest fruit and vegetable import market with an annual import turnover of up to 150 billion USD, but Vietnam’s market share only accounts for 0.18% of the EU’s total import value.

The reason is partly because Vietnamese fruits and vegetables have not complied with the strict standards of this region. On the other hand, due to the lack of Vietnamese-owned fruit and vegetable distribution channels, some Vietnamese vegetables and fruits are exported to the EU but use other countries’ brands when consumed, causing the brand of Vietnamese fruits and vegetables to be affected. Therefore, the problem of building a Vietnamese fruit and vegetable brand in the EU market is a very urgent problem in the near future.

According to Mr. Nguyen Minh Tien, Director of the Center for Agricultural Trade Promotion (Ministry of Agriculture and Rural Development), to conquer the EU market, Vietnamese fruit and vegetable exporters need to learn from leading countries. in this field. For example, in Australia, the country’s vegetable, flower and fruit production industry is said to be on track to achieve the goal of reaching 20 billion USD in export value by 2030; At current growth rates, Australia could achieve that as early as 2025-2026. To develop the fruit and vegetable industry, Australia has developed a three-point policy, including: improving farmers’ income; enhance the competitiveness of vegetable, flower and fruit products; improve the sustainability of this industry…

Source: https://vneconomy.vn/buoc-dai-nhay-vot-trong-xuat-khau-rau-qua.htm